Waterville’s Opportunity Zone + Tax Incentives

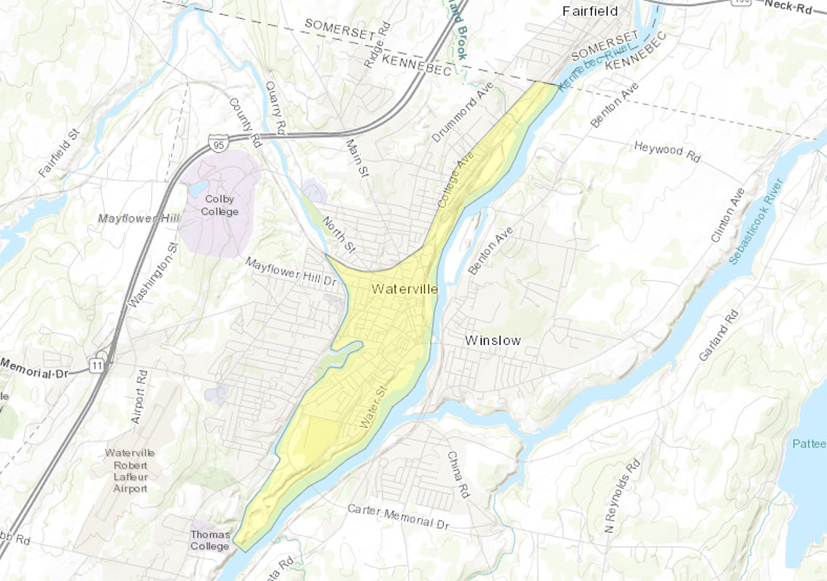

Waterville’s Opportunity Zone is within the highlighted census tract (yellow), which includes the City of Waterville’s downtown district.

Program Overview

In May 2018, Governor LePage named Waterville census tract 23011024102, which includes the city’s downtown area, as one of Maine’s thirty-two (32) Opportunity Zones (OZ). The tax benefit program, established in the federal Tax Cuts and Jobs Act of 2017 and governed by the IRS[1], intends to convert U.S. investors’ $2.3 trillion in unrealized capital gains into private investment in low-income communities (“Opportunity Zones”), thereby stimulating growth, creating jobs, and increasing prosperity of residents.

[1] As designated in the Tax Cuts and Jobs Act of 2017, Internal Revenue Code §§ 1400Z–1 and 1400Z–2

Downtown Waterville

With eligibility in Waterville’s downtown district, inclusion into the OZ program comes at an exciting time for the city. With over $100 million recently invested in downtown projects, the OZ program stands to leverage and capitalize on existing revitalization efforts. Moreover, during the past few years downtown Waterville has witnessed over 20 acquisitions of commercial properties, continued population growth, and increases in retail sale figures.

Opportunity Fund

The OZ program delays, reduces, and/or eliminates taxation on capital gains (see next page for explanations). In order to reap these benefits, a corporation or individual must establish an Opportunity Fund (OF), an investment vehicle organized as a corporation or partnership in order to invest in qualified OZ property.

The OF must have at least 90% of its assets in qualified OZ property, which may include qualified OZ stock, qualified OZ partnership interest, or qualified OZ business property, all of which must have been acquired by the OF after Dec. 31, 2017.[1] An investor may defer gains invested into an OF during the 180-day period beginning on the date of sale of the asset to which the deferral pertains.

[1] U.S. House of Representatives. (2017, Dec. 15). “Tax Cuts and Jobs Act – Conference Report.” U.S. Government Publishing Service, pg. 136-137. https://www.congress.gov/115/crpt/hrpt466/CRPT-115hrpt466.pdf.

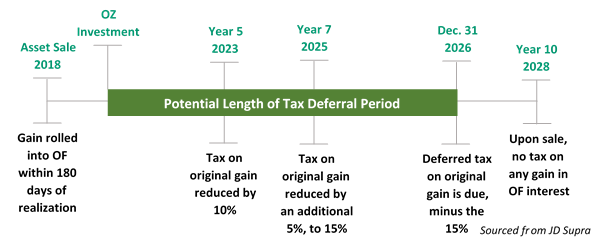

There are three tax incentives associated with the OZ program:

- Temporary Deferral – If invested in a qualified OF, certain realized gains will not be included in gross (taxable) income until the earlier of the following dates: when the OF is disposed; or December 31, 2026.

- Example: An investor rolls over $100 of capital gains into the OF. Taxation on that $100 is deferred until 2026.

- Step-up in Basis – The basis is increased by 10% if capital gains reinvested into an OF are held by the taxpayer for at least 5 years, and increased by an additional 5% if held for at least 7 years. Thus, up to 15% of the original gain is exempt from taxation.

- Example: An investor rolls over $100 of capital gains into the OF. Taxation is deferred on the $100, and the investor pays taxes on only $90 if investment is held for 5<x<7 years, or on only $85 if investment is held 7<x<10 years. Investor also pays capital gains tax on appreciation of the original $100.

- Permanent Exclusion – If an investment in an OF is held for at least 10 years, the gains accrued in that investment (once sold or exchanged) are exempt from taxation.

- Example: An investor rolls over $100 of capital gains into the OF. Taxation is deferred on the $100, and the investor pays taxes on only $85. Investor pays no taxes on appreciation.

On Dec. 31, 2026, the lesser of the following will be recognized:

- The remaining deferred gain (accounting for step-up basis)

- The fair-market value of the investment in the OF

An investor may defer gains invested into an OF during the 180-day period beginning on the date of sale of the asset to which the deferral pertains.