WATERVILLE, ME – Central Maine Growth Council (CMGC) is proud to announce its launch of one of the first economic development corporation-owned Qualified Opportunity Funds in the State of Maine and country. This investment vehicle will attract and allocate funding to real estate and business equity opportunities in downtown Waterville’s Opportunity Zone, which was designated by former Governor LePage after the passage of the 2017 Tax Cuts and Jobs Act.

“We are excited to develop the Elm City Opportunity Fund and present access to what the opportunity zone framework provides. In particular, the fund enables us to translate our historic record of investment in the downtown into an even more favorable return profile given the unprecedented tax benefits by the fund,” said Garvan D. Donegan, director of planning and economic development at Central Maine Growth Council. “Principally, this initiative will stimulate further direct investment into the city and its downtown by presenting a pathway of access to this powerful incentive program for a more diverse array of investors, including small, mid-sized, and family-scale investors and businesses.”

Whereas most opportunity funds are managed by private real estate or equity firms, the Elm City Opportunity Fund is distinctive because it is managed by an economic development organization – the Central Maine Growth Council. This is the first such fund in New England and one of the first in the country.

The establishment and operation of a multi-investor, multi-project fund allows CMGC to further its mission of creating the conditions for economic growth to occur. By managing the legal, fiscal, and operational aspects of the fund, CMGC reduces barriers to investment in the Opportunity Zone and employs its deep knowledge of the local economy to allocate capital to its highest and best use.

Moreover, the mission of CMGC is reflected in the fund’s investment guidelines, which favor projects yielding local community and social benefit.

In recent years, local economic growth has boomed in large part to the completed and planned investment of over $125 million into downtown Waterville. This investment has funded the redevelopment of Waterville’s iconic riverside mill complexes and the construction of a mixed-use residential facility and a hotel, with capital currently being raised for a new arts center. This development pattern mirrors the investment that is possible under the Opportunity Zone framework, providing strong evidence for Waterville’s appeal to investors.

Advising on the establishment and operation of CMGC’s fund is Wipfli, one of the largest accounting firms in New England with national expertise in Opportunity Zones. “By having an organization with experience and the ability to affect real change with the Elm City Opportunity Fund, there should be an ‘opportunity’ for investors to benefit from capital gains deferral and reduction, while those within the zone truly benefit from the guiding hand of CMGC’s involvement and interest in the fund,” explains Jim Cardosi, tax manager at Wipfli.

Opportunity Zones and their corresponding Qualified Opportunity Funds are the newest federal incentive tool for economic and community development. Investing in a Qualified Opportunity Fund allows the investor to defer or eliminate capital gains taxes, depending on the length of their investment. In addition, investment in a fund, which is commonly in commercial or residential real estate, diversifies an investor’s portfolio, thereby reducing risk. At least 90% of the investment must be allocated to an Opportunity Zone, so designated due to its economic distress, to spur prosperity and job creation.

Information on the Elm City Opportunity Fund is available online at www.centralmaine.org/waterville-opportunity-zone, and potential developers, investors, or other interested parties may contact Central Maine Growth Council at 207-680-7300 or director@centralmaine.org for more information.

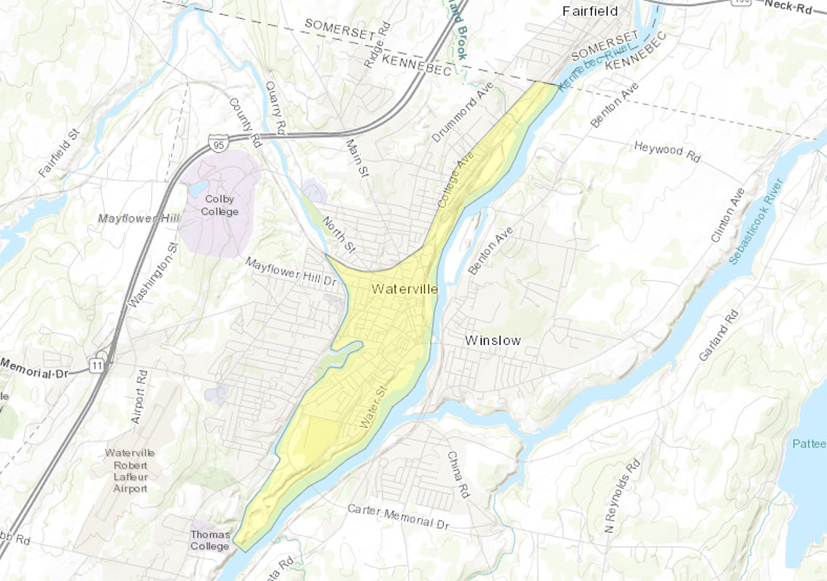

Waterville’s Opportunity Zone is within the highlighted census tract (yellow). The OZ represents approx. 1,000 acres along the Kennebec River and includes the City of Waterville’s downtown district.

Last modified: September 25, 2019